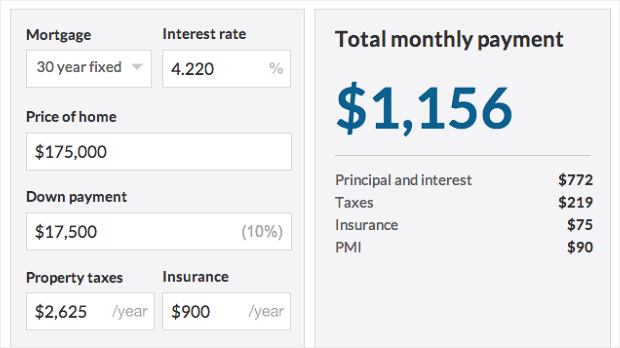

Your creditworthiness determines the interest rate a lender will offer to charge you. Additionally, some loans do not require PMI with a down payment that is less than 20%, so it’s important to explore and compare your options.Īn interest rate is the amount that a lender charges you in exchange for providing the loan, expressed as a percentage of the loan amount. You can avoid paying PMI by purchasing a less expensive home, or by simply waiting until you’re able to afford at least 20% for your down payment. PMI is designed to protect the lender, not the buyer, in the event that the buyer defaults on their payments. PMI is insurance that some home lenders require you to pay if you make a down payment of less than 20%. If you put down less than 20%, you’ll need to pay PMI because lenders see the loan as higher risk. In the United States, the ideal down payment for a house is 20%, but people typically make down payments from anywhere between 5% and 20% depending on the loan.Īside from owing less on your home, there are other advantages to putting at least 20% toward your down payment, such as not having to pay private mortgage insurance (PMI). It’s represented by a percentage of the total price of the purchase. In general, mortgage lenders look for a DTI that’s no greater than 36%.Ī down payment is a cash payment that you make at the onset of a large purchase, such as a new home. A lower DTI indicates a healthy balance between debt and income. The lower your DTI percentage is, the more favorably lenders will look at you. Lenders look at DTI as a way of gauging your ability to make on-time monthly payments on a loan. While there’s no single way to define a good credit score or bad credit score, VantageScore does provide guidance on grading score on a scale of A to F:ĭebt to income (DTI) ratio is a percentage that expresses how much of your pre-tax annual income is dedicated to your monthly debt payments. Your VantageScore is determined by six factors: Mint utilizes the VantageScore model, which measures credit on a scale ranging from 300 to 850. Lenders use it to determine how likely you are to make on-time payments on your loans.ĭifferent credit scoring models calculate credit scores based on a variety of factors. A credit score is a number assigned to you to represent your creditworthiness.

0 kommentar(er)

0 kommentar(er)